US inheritance taxes for Swiss investors (in German)

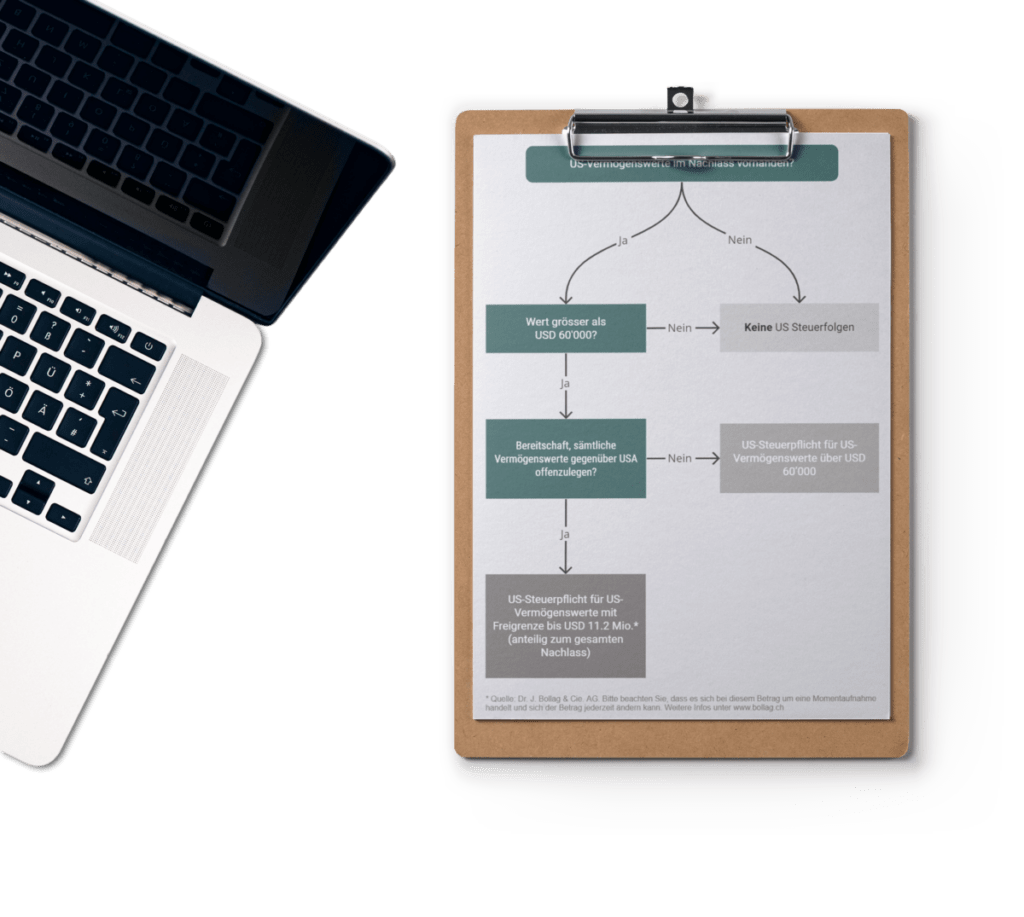

Der Autor dieses Artikels, RA Dr. iur. Jacob Bollag, ist Legal Counsel und geschäftsführendes Mitglied des Verwaltungsrats der Dr. J. Bollag & Cie. AG. Erblasser ohne US-Staatsbürgerschaft oder US-Niederlassung haben unter Umständen die US-Erbschaftssteuer zu beachten. Namentlich trifft dies zu bei US-Vermögenswerten im Nachlass, die gesamthaft einen Wert von über USD 60’000 aufweisen. Dazu zählen insbesondere […]

Digital General Assembly in the New Stock Corporation Law (in German)

Taxes in Switzerland: Voluntary Self-Denunciation

The author of this article, MLaw Dr. phil. Tetyana Miller, is legal counsel at Dr. J. Bollag & Cie. AG . What to do if you forget to report income or assets on your tax return in Switzerland? There are situations, when you negligently or deliberately make a false or incomplete statement of your income […]

Corporate law: Company limited by shares under new Swiss corporate law

The author of this article, MLaw Dr. phil. Tetyana Miller, is legal counsel at Dr. J. Bollag & Cie. AG and specialises in corporate law. The Federal Council brought the new company law adopted in 2020 into force effective 1 January 2023. At the same time, the Commercial Register Ordinance was amended. The Essentials of […]

Immigration law: Family Reunification in Switzerland

The author of this article, Zlatko Janev, is an attorney-at-law and legal counsel as well as head of the legal department at Dr. J. Bollag & Cie. AG. His main activities include advising and representing clients in the area of immigration law. Requirements for family reunificationA person who has Swiss citizenship or a permanent residence […]

Inheritance law: Can compulsory heirs be excluded from a will?

The author of this article, Dr. iur. Jacob Bollag, attorney-at-law, is legal counsel at Dr. J. Bollag & Cie. AG and has dealt with the topic of virtual heirs in depth as part of his doctoral thesis. Entitlement to a compulsory portion and freedom of disposal in Swiss inheritance lawIn contrast to many foreign legal […]

Inheritance Law: How you can maximally benefit your spouse and avoid buyout issues (in German)

Interview: Questions in Foreigners’ Law (in German)